|

The Town of Warren and Discover Warren as part of their business round-table discussion will welcome Senator Jack Reed Thursday, April 30, 2020 at 5:00 pm

The discussions will be conducted via the Zoom meeting application and are open to all businesses and interested individuals. To Join Thursday's Zoom meeting, log on to https://us02web.zoom.us/j/83548675213?pwd=amNaRGtYMOINTExrSORSem1DcVFEUT09 Meeting ID: 835 4867 5213 Password: 024309 Find your local number: https://us02web.zoom.us/u/kek9mIhH5F

0 Comments

MICROENTERPRISE STABILIZATION GRANT PROGRAM

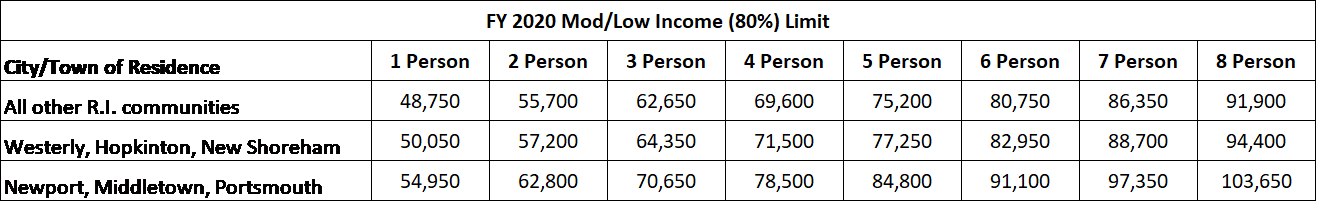

THE TOWN OF BRISTOL WILL BEGIN ACCEPTING APPLICATIONS WEDNESDAY, APRIL 29TH, 2020. APPLICATION MATERIAL WILL BE AVAILABLE at http://www.bristolri.gov/749/MicroE The Town of Bristol, with Community Development Block Grant (CDBG) funds provided by the R. I. Office of Housing and Community Development (OHCD) and the U.S. Department of Housing and Urban Development (HUD), is offering working capital grants to qualifying small business microenterprises adversely impacted by COVID-19. Eligible Businesses: Certain types of microenterprises are eligible. A microenterprise is defined as a commercial enterprise that has five or fewer employees, one or more of whom owns the enterprise. The microenterprise owner’s gross annual family income may not exceed the applicable threshold below, based on family size and city/town where you live (not where your business is located). read more: http://www.bristolri.gov/749/MicroE State House Activity

The legislature cancelled all sessions and committee hearings for the week April 27 - May 1. The House Speaker and the Senate President created a Joint Legislative Task Force on COVID-19 Emergency Spending. There are ten members on the joint committee. The first meeting will be held April 30th. Details surrounding where and how this meeting will be posted on the legislative website http://www.rilegislature.gov/pages/legislation.aspx Revenue Estimating Conference Begins Work The Revenue Estimating Conference (REC) began its work Friday April 24th with the Caseload estimates. This REC committee is comprised of the House Fiscal Staff, the Senate Fiscal Staff and the Department of Revenue Staff. This group is charged with taking a deep dive into the state caseload numbers, and the revenues collected or to be collected. The schedule is listed below. The end goal is to reach a consensus on the surplus or deficit for the current fiscal year as well as the revenue that will be considered available for the FY2021 budget The remainder of the REC meetings will take place as follows and are broadcast on CapitolTV via Cox Channels 15 and 61, in high definition on Cox Channel 1013, on Full Channel on Channel 15 and on Channel 34 by Verizon subscribers. It will also be live streamed at www.rilegislature.gov/CapTV Wednesday, April 29, 2020 – Economic Overview and Testimony 9:00 A.M. US and RI Economic Forecasts – IHS Markit Michael Lynch, Economist RI Labor Market Conditions-Department of Labor and Training Donna Murray, Assistance Director, Labor Market Information Unit Consensus Economic Forecast 10:30 A.M. Unclaimed Property - Office of the General Treasurer Historic Structures Tax Credits - Historical Preservation and Heritage Commission Motion Picture Production Tax Credits - RI Film and Television Office Commerce Corporation Tax Credits, Commerce Corporation Lottery Receipts - Department of Revenue, Division of Lottery Friday, May 1, 2020 – Follow-up Testimony 9:00 AM Cash Assistance and Medical Caseloads – Department of Human Services and Executive Office of Health and Human Services Monday, May 4, 2020 - Testimony 2:30 P.M. Tax Collections – Department of Revenue, Division of Taxation Neena Savage, State Tax Administrator Accruals – Accounts and Controls Peter Keenan, State Controller Tuesday, May 5, 2020 – Caseload Estimate 9:00 A.M. Caseload Estimating Conference Wednesday, May 6, 2020 – Follow-up Testimony (if needed) 11:00 A.M Tax Collections – Department of Revenue, Division of Taxation Neena Savage, State Tax Administrator Friday, May 8, 2020 – Revenue Estimate 9:00 A.M. Revenue Estimating Conference – this should be the final meeting where the final numbers will be adopted RI Works Caseload Update Testimony surrounding the Rhode Island Works (RIW) was provided at the REC meeting Friday. The RI Works program supports adult family members to work by offering the following benefits and services:

For a more in depth look at the Rhode Island Works program testimony provided at the Revenue Estimating Conference, go to: http://www.rilegislature.gov/April%2028%202020%202020%20CCREC/DHS%20May%202020%20Caseload%20Document.pdf\  Town of Warren Business Microenterprise Stabilization Grant (MicroE) Program The Town of Warren, with Community Development Block Grant (CDBG) funds provided by the R. I. Office of Housing and Community Development (OHCD) and the U.S. Department of Housing and Urban Development (HUD), is offering working capital grants to qualifying small business microenterprises adversely impacted by COVID-19. Eligible Businesses: Certain types of microenterprises are eligible. A microenterprise is defined as a commercial enterprise that has five or fewer employees, one or more of whom owns the enterprise. The microenterprise owner’s gross annual family income may not exceed the applicable threshold , based on family size and city/town where you live (not where your business is located). Businesses must meet the following eligibility criteria:

Business Microenterprise Stabilization Grant (MicroE) Program Uses of Funds: Funds may be used for working capital to cover business costs, such as rent, staffing, and utilities. MicroE funds may not be used for major equipment purchases, purchase of real property, construction activities, business expansion, or lobbying. Excluded Business Types: The following business types are excluded from participating in this program:

FOR COMPLETE PROGRAM GUIDELINES AND APPLICATION MATERIALS, CONTACT: Bob Rulli, Director Office of Planning & Community Development [email protected] State House Activity

The General Assembly cancelled all hearings and meetings for this week as the State expects cases of coronavirus to peak sometime in the next two weeks. Unemployment Compensation Update and Federal Funds Commerce RI coordinated a conference call with members of the business community last week. During the April 15th call, the Chamber heard from Department of Labor Director Scott Jensen. As of April 15th, 154,000 Rhode Islanders filed for unemployment benefits (although the Director did say that some of the 154,000 may be duplicate applications so the number may be somewhat overstated). To provide a perspective of caseloads, he said that on April 7th alone, there were 15,000 claims filed. Approximately $107 million has been paid out as of last week, which represents 1/5 of the amount available in the Unemployment Trust Fund. Should the fund be zeroed out by claims, the State will then borrow from the federal government to meet benefit requirements. Director Jensen also said that companies that lay off employees due to coronavirus fallout, will not be penalized through their experience rating once the economy restarts and employment returns to “normal.” Governor Raimondo announced that the State received $625 million in federal funds last week. A total of $1.25 billion is expected to be received – the remainder should reach the state treasury in the next couple weeks. However, federal guidelines as to exactly how the money can be used have not been provided to states yet. Those guidelines should be released soon. Mask Requirement Reminder Last week, the Governor signed an executive order issuing clear direction about face coverings. The following directives are in effect:

Governor Looks for Chamber Input Governor Raimondo is asking Chambers of Commerce and other industry groups to think about ways to safely re-open the State’s economy in phases. Once the State experiences 14 days of declining coronavirus cases, the first phase of re-opening can begin. Re-opening will likely require some type of social distancing as well as cleaning requirements and customer flow regulations; but different types of businesses will likely require different types of regulations. The Chamber will continue to work with the Governor and her team to develop ideas to help in this endeavor. Virtual Business Round-table Discussions

Tuesday’s at 10 AM and Thursday’s at 5 PM The Town of Warren and Discover Warren will be hosting twice weekly business round-table discussions Tuesday’s at 10 AM and Thursday’s at 5 PM. The discussions will be conducted via the Zoom meeting application and are open to all businesses and interested individuals. Among the topics to be discussed will be the latest information available for small business assistance, resources available, success stories during these unprecedented times and also an opportunity for participants to discuss their concerns and needs. Katie Dickinson one of the Co-Founders of Discover Warren stated, “ the coffee hour on Tuesday and the cocktail hour on Thursday gives us an opportunity to connect, albeit in a new way as a community.” The discussions will be moderated by Bob Rulli, Director of Planning & Community Development for the Town. Discover Warren’s other Co-Founder Keri Cronin added, “none of us know at the moment what the other side is going to look like when we get through this crisis, these discussions we help us be prepared to revitalize our local economy as quickly as we can when we get there.” Tuesday 10 AM Join Zoom Meeting https://zoom.us/j/95418951255?pwd=bTVaNVhzaUF4VkIwOUdPK0MwM2pNUT09 Meeting ID: 954 1895 1255 Password: 031514 Find your local number: https://zoom.us/u/abdFIfEskN Thursday 5 PM Join Zoom Meeting https://zoom.us/j/97011841080?pwd=NmpreG02aFVsQ1M4Y1ZUZ1lvYXgrUT09 Meeting ID: 970 1184 1080 Password: 029296 Find your local number: https://zoom.us/u/abdFIfEskN" State House Activity

This week was scheduled to be spring legislative break week for the General Assembly. The Speaker’s office did state that the House Finance Committee hopes to convene “in the coming weeks” to discuss the budget situation as it continues to evolve. The Revenue Estimating Conference process may start in late April with the actual conference taking place on May 5th and May 8th. The exact schedule is still being finalized, but all proceedings will be available for remote public viewing via Capitol TV. (obtained via an Ian Donnis report) All of this planning depends upon the timing of the coronavirus peak, however. The Revenue Estimating Conference takes place each year and is the meeting where the Governor’s budget staff, the House Fiscal staff and the Senate Fiscal staff determine how much revenue is expected in the upcoming fiscal year as well as what fixed expenses look like. The three sides must reach a consensus on the numbers before the budget can be “built.” It is a crucial part of the state’s budget process. DEM Holds Heating Sector Decarbonization Meeting The RI Department of Environmental Management hosted a zoom meeting April 7th to continue the discussion of the possibility of decarbonizing the Rhode Island heating sector. The heating sector accounts for 34% of total state carbon emissions. The state’s consultant – The Brattle Group - also added that if renewable gas was available, it would likely only supply 13% of the U.S. national gas demand and would model at $20/MMBtu for those customers that get their hands on the limited supply. Above $20/MMBtu, customers would have no incentive to use the renewable fuel. To get a better handle on the price associated with decarbonization, The Brattle Group suggested conducting a survey of Rhode Islanders to determine what heating equipment is currently being utilized in residential and commercial buildings, as well as the age of the equipment. This would provide valuable information concerning the potential timeframe tied to changing fuel sources in buildings and allow for modeling surrounding the decreasing use of the natural gas infrastructure (the experts pointed out that as the number of natural gas customers decreases, the fixed natural gas infrastructure costs will be borne by fewer people, therefore making natural gas more expensive). One interesting finding - if consumers purchase a variety of renewable energy for their heating needs (renewable gas, renewable oil, ground source heat pumps or air source heat pumps), the electric grid will still require double the current electricity generation to meet peak demand. A doubling of the generation demand was already predicted as necessary if consumers chose all ground source electric heating pumps or all air source electric heating pumps for their heating needs. When this research project started, a final report was scheduled to be released April 22, 2020. DEM still hopes to meet that deadline. The report will be posted on the DEM website once completed. As of April 6, 2020

PAYCHECK PROTECTION PROGRAM LOANS Frequently Asked Questions (FAQs) The Small Business Administration (SBA), in consultation with the Department of the Treasury, intends to provide timely additional guidance to address borrower and lender questions concerning the implementation of the Paycheck Protection Program (PPP), established by section 1102 of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act or the Act). This document will be updated on a regular basis. Borrowers and lenders may rely on the guidance provided in this document as SBA’s interpretation of the CARES Act and of the Paycheck Protection Program Interim Final Rule (“PPP Interim Final Rule”) (link). The U.S. government will not challenge lender PPP actions that conform to this guidance,1 and to the PPP Interim Final Rule and any subsequent rulemaking in effect at the time.

Answer: No. Providing an accurate calculation of payroll costs is the responsibility of the borrower, and the borrower must attest to the accuracy of those calculations. Lenders are expected to perform a good faith review, in a reasonable time, of the borrower’s calculations and supporting documents concerning average monthly payroll cost. The level of diligence by a lender should be informed by the quality of supporting documents supplied by the borrower. Minimal review of calculations based on a payroll report by a recognized third-party payroll processor, for example, would be reasonable. If lenders identify errors in the borrower’s calculation or material lack of substantiation in the borrower’s supporting documents, the lender should work with the borrower to remedy the error.

Answer: No. Small business concerns can be eligible borrowers even if they have more than 500 employees, as long as they satisfy the existing statutory and regulatory definition of a “small business concern” under section 3 of the Small Business Act, 15 U.S.C. 632. A business can qualify if it meets the SBA employee-based or revenue-1 This document does not carry the force and effect of law independent of the statute and regulations on which it is based. As of April 6, 2020 based size standard corresponding to its primary industry. Go to www.sba.gov/size for the industry size standards. Additionally, a business can qualify for the Paycheck Protection Program as a small business concern if it met both tests in SBA’s “alternative size standard” as of March 27, 2020: (1) maximum tangible net worth of the business is not more than $15 million; and (2) the average net income after Federal income taxes (excluding any carry-over losses) of the business for the two full fiscal years before the date of the application is not more than $5 million. A business that qualifies as a small business concern under section 3 of the Small Business Act, 15 U.S.C. 632, may truthfully attest to its eligibility for PPP loans on the Borrower Application Form, unless otherwise ineligible. 3. Question: Does my business have to qualify as a small business concern (as defined in section 3 of the Small Business Act, 15 U.S.C. 632) in order to participate in the PPP? Answer: No. In addition to small business concerns, a business is eligible for a PPP loan if the business has 500 or fewer employees whose principal place of residence is in the United States, or the business meets the SBA employee-based size standards for the industry in which it operates (if applicable). Similarly, PPP loans are also available for qualifying tax-exempt nonprofit organizations described in section 501(c)(3) of the Internal Revenue Code (IRC), tax-exempt veterans organization described in section 501(c)(19) of the IRC, and Tribal business concerns described in section 31(b)(2)(C) of the Small Business Act that have 500 or fewer employees whose principal place of residence is in the United States, or meet the SBA employee-based size standards for the industry in which they operate. 4. Question: Are lenders required to make an independent determination regarding applicability of affiliation rules under 13 C.F.R. 121.301(f) to borrowers? Answer: No. It is the responsibility of the borrower to determine which entities (if any) are its affiliates and determine the employee headcount of the borrower and its affiliates. Lenders are permitted to rely on borrowers’ certifications. 5. Question: Are borrowers required to apply SBA’s affiliation rules under 13 C.F.R. 121.301(f)? Answer: Yes. Borrowers must apply the affiliation rules set forth in SBA’s Interim Final Rule on Affiliation. A borrower must certify on the Borrower Application Form that the borrower is eligible to receive a PPP loan, and that certification means that the borrower is a small business concern as defined in section 3 of the Small Business Act (15 U.S.C. 632), meets the applicable SBA employee-based or revenue-based size standard, or meets the tests in SBA’s alternative size standard, after applying the affiliation rules, if applicable. SBA’s existing affiliation exclusions apply to the PPP, including, for example the exclusions under 13 CFR 121.103(b)(2). As of April 6, 2020 6. Question: The affiliation rule based on ownership (13 C.F.R. 121.301(f)(1)) states that SBA will deem a minority shareholder in a business to control the business if the shareholder has the right to prevent a quorum or otherwise block action by the board of directors or shareholders. If a minority shareholder irrevocably gives up those rights, is it still considered to be an affiliate of the business? Answer: No. If a minority shareholder in a business irrevocably waives or relinquishes any existing rights specified in 13 C.F.R. 121.301(f)(1), the minority shareholder would no longer be an affiliate of the business (assuming no other relationship that triggers the affiliation rules). 7. Question: The CARES Act excludes from the definition of payroll costs any employee compensation in excess of an annual salary of $100,000. Does that exclusion apply to all employee benefits of monetary value? Answer: No. The exclusion of compensation in excess of $100,000 annually applies only to cash compensation, not to non-cash benefits, including: · employer contributions to defined-benefit or defined-contribution retirement plans; · payment for the provision of employee benefits consisting of group health care coverage, including insurance premiums; and · payment of state and local taxes assessed on compensation of employees. 8. Question: Do PPP loans cover paid sick leave? Answer: Yes. PPP loans covers payroll costs, including costs for employee vacation, parental, family, medical, and sick leave. However, the CARES Act excludes qualified sick and family leave wages for which a credit is allowed under sections 7001 and 7003 of the Families First Coronavirus Response Act (Public Law 116–127). Learn more about the Paid Sick Leave Refundable Credit here. 9. Question: My small business is a seasonal business whose activity increases from April to June. Considering activity from that period would be a more accurate reflection of my business’s operations. However, my small business was not fully ramped up on February 15, 2020. Am I still eligible? Answer: In evaluating a borrower’s eligibility, a lender may consider whether a seasonal borrower was in operation on February 15, 2020 or for an 8-week period between February 15, 2019 and June 30, 2019. 10. Question: What if an eligible borrower contracts with a third-party payer such as a payroll provider or a Professional Employer Organization (PEO) to process payroll and report payroll taxes? Answer: SBA recognizes that eligible borrowers that use PEOs or similar payroll providers are required under some state registration laws to report wage and other data on As of April 6, 2020 the Employer Identification Number (EIN) of the PEO or other payroll provider. In these cases, payroll documentation provided by the payroll provider that indicates the amount of wages and payroll taxes reported to the IRS by the payroll provider for the borrower’s employees will be considered acceptable PPP loan payroll documentation. Relevant information from a Schedule R (Form 941), Allocation Schedule for Aggregate Form 941 Filers, attached to the PEO’s or other payroll provider’s Form 941, Employer’s Quarterly Federal Tax Return, should be used if it is available; otherwise, the eligible borrower should obtain a statement from the payroll provider documenting the amount of wages and payroll taxes. In addition, employees of the eligible borrower will not be considered employees of the eligible borrower’s payroll provider or PEO. 11. Question: May lenders accept signatures from a single individual who is authorized to sign on behalf of the borrower? Answer: Yes. However, the borrower should bear in mind that, as the Borrower Application Form indicates, only an authorized representative of the business seeking a loan may sign on behalf of the business. An individual’s signature as an “Authorized Representative of Applicant” is a representation to the lender and to the U.S. government that the signer is authorized to make the certifications, including with respect to the applicant and each owner of 20% or more of the applicant’s equity, contained in the Borrower Application Form. Lenders may rely on that representation and accept a single individual’s signature on that basis. 12. Question: I need to request a loan to support my small business operations in light of current economic uncertainty. However, I pleaded guilty to a felony crime a very long time ago. Am I still eligible for the PPP? Answer: Yes. Businesses are only ineligible if an owner of 20 percent or more of the equity of the applicant is presently incarcerated, on probation, on parole; subject to an indictment, criminal information, arraignment, or other means by which formal criminal charges are brought in any jurisdiction; or, within the last five years, for any felony, has been convicted; pleaded guilty; pleaded nolo contendere; been placed on pretrial diversion; or been placed on any form of parole or probation (including probation before judgment). 13. Question: Are lenders permitted to use their own online portals and an electronic form that they create to collect the same information and certifications as in the Borrower Application Form, in order to complete implementation of their online portals? Answer: Yes. Lenders may use their own online systems and a form they establish that asks for the same information (using the same language) as the Borrower Application Form. Lenders are still required to send the data to SBA using SBA’s interface. 14. Question: What time period should borrowers use to determine their number of employees and payroll costs to calculate their maximum loan amounts? As of April 6, 2020 Answer: In general, borrowers can calculate their aggregate payroll costs using data either from the previous 12 months or from calendar year 2019. For seasonal businesses, the applicant may use average monthly payroll for the period between February 15, 2019, or March 1, 2019, and June 30, 2019. An applicant that was not in business from February 15, 2019 to June 30, 2019 may use the average monthly payroll costs for the period January 1, 2020 through February 29, 2020. Borrowers may use their average employment over the same time periods to determine their number of employees, for the purposes of applying an employee-based size standard. Alternatively, borrowers may elect to use SBA’s usual calculation: the average number of employees per pay period in the 12 completed calendar months prior to the date of the loan application (or the average number of employees for each of the pay periods that the business has been operational, if it has not been operational for 12 months). 15. Question: Should payments that an eligible borrower made to an independent contractor or sole proprietor be included in calculations of the eligible borrower’s payroll costs? Answer: No. Any amounts that an eligible borrower has paid to an independent contractor or sole proprietor should be excluded from the eligible business’s payroll costs. However, an independent contractor or sole proprietor will itself be eligible for a loan under the PPP, if it satisfies the applicable requirements. 16. Question: How should a borrower account for federal taxes when determining its payroll costs for purposes of the maximum loan amount, allowable uses of a PPP loan, and the amount of a loan that may be forgiven? Answer: Under the Act, payroll costs are calculated on a gross basis without regard to (i.e., not including subtractions or additions based on) federal taxes imposed or withheld, such as the employee’s and employer’s share of Federal Insurance Contributions Act (FICA) and income taxes required to be withheld from employees. As a result, payroll costs are not reduced by taxes imposed on an employee and required to be withheld by the employer, but payroll costs do not include the employer’s share of payroll tax. For example, an employee who earned $4,000 per month in gross wages, from which $500 in federal taxes was withheld, would count as $4,000 in payroll costs. The employee would receive $3,500, and $500 would be paid to the federal government. However, the employer-side federal payroll taxes imposed on the $4,000 in wages are excluded from payroll costs under the statute. 22 The definition of “payroll costs” in the CARES Act, 15 U.S.C. 636(a)(36)(A)(viii), excludes “taxes imposed or withheld under chapters 21, 22, or 24 of the Internal Revenue Code of 1986 during the covered period,” defined as February 15, 2020, to June 30, 2020. As described above, the SBA interprets this statutory exclusion to mean that payroll costs are calculated on a gross basis, without subtracting federal taxes that are imposed on the employee or withheld from employee wages. Unlike employer-side payroll taxes, such employee-side taxes are ordinarily expressed as a reduction in employee take-home pay; their exclusion from the definition of payroll costs means payroll costs should not be reduced based on taxes imposed on the employee or withheld from employee wages. This interpretation is consistent with the text of the statute and advances the legislative purpose of ensuring workers As of April 6, 2020 17. Question: I filed or approved a loan application based on the version of the PPP Interim Final Rule published on April 2, 2020. Do I need to take any action based on the updated guidance in these FAQs? Answer: No. Borrowers and lenders may rely on the laws, rules, and guidance available at the time of the relevant application. However, borrowers whose previously submitted loan applications have not yet been processed may revise their applications based on clarifications reflected in these FAQs. 18. Question: Are PPP loans for existing customers considered new accounts for FinCEN Rule CDD purposes? Are lenders required to collect, certify, or verify beneficial ownership information in accordance with the rule requirements for existing customers? Answer: If the PPP loan is being made to an existing customer and the necessary information was previously verified, you do not need to re-verify the information. Furthermore, if federally insured depository institutions and federally insured credit unions eligible to participate in the PPP program have not yet collected beneficial ownership information on existing customers, such institutions do not need to collect and verify beneficial ownership information for those customers applying for new PPP loans, unless otherwise indicated by the lender’s risk-based approach to BSA compliance.  State House Activity The State House remains closed until further notice. The State House will be lit in red lights to honor all first responders as they work to keep the rest of us safe. Eggs and Issues Due to the coronavirus, the Chamber has rescheduled the Eggs and Issues breakfast with the Speaker of the House to September 22nd. You will be receiving a notice as the time approaches. Lt. Governor Host Small Business Forums Lieutenant Governor Dan McKee is hosting business forum conference calls for small businesses on Tuesdays and Fridays at noon (12:00 p.m.). If you would like to participate, Call 866-880-0098 and use the following passcode number: 54933514#. Phone-in attendance has been high, so please place your telephone on mute while the conference call is underway. Secretary of State Business Services Update In an effort to protect the health and safety the Secretary of State’s office has implemented the following changes to the operation of the Business Services Division.

The Secretary of State Nellie Gorbea reminds everyone that the Presidential Primary has been moved to Tuesday, June 2nd. The new voter registration deadline is May 3rd. Mail ballot applications are due April 7th, so if you have not filled one out yet, you will likely have to vote in person unless further changes to the procedure are made. SMALL BUSINESS PAYCHECK PROTECTION PROGRAM

The Paycheck Protection Program provides small businesses with funds to pay up to 8 weeks of payroll costs including benefits. Funds can also be used to pay interest on mortgages, rent, and utilities. Fully Forgiven Funds are provided in the form of loans that will be fully forgiven when used for payroll costs, interest on mortgages, rent, and utilities (due to likely high subscription, at least 75% of the forgiven amount must have been used for payroll). Loan payments will also be deferred for six months. No collateral or personal guarantees are required. Neither the government nor lenders will charge small businesses any fees. Must Keep Employees on the Payroll—or Rehire Quickly Forgiveness is based on the employer maintaining or quickly rehiring employees and maintaining salary levels. Forgiveness will be reduced if full-time headcount declines, or if salaries and wages decrease. All Small Businesses Eligible Small businesses with 500 or fewer employees—including nonprofits, veterans organizations, tribal concerns, self-employed individuals, sole proprietorships, and independent contractors— are eligible. Businesses with more than 500 employees are eligible in certain industries. When to Apply Starting April 3, 2020, small businesses and sole proprietorships can apply. Starting April 10, 2020, independent contractors and self-employed individuals can apply. We encourage you to apply as quickly as you can because there is a funding cap. How to Apply You can apply through any existing SBA 7(a) lender or through any federally insured depository institution, federally insured credit union, and Farm Credit System institution that is participating. Other regulated lenders will be available to make these loans once they are approved and enrolled in the program. You should consult with your local lender as to whether it is participating. All loans will have the same terms regardless of lender or borrower. A list of participating lenders as well as additional information and full terms can be found at www.sba.gov. The Paycheck Protection Program is implemented by the Small Business Administration with support from the Department of the Treasury. Lenders should also visit www.sba.gov or www.coronavirus.gov for more information. |

Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed