|

Unemployment Trust Fund Call to Action

The Chamber needs your help! As the discussions continue over how to spend roughly $2 billion, there seems to still be some question as to whether the Unemployment Trust Fund will be partially replenished after the pandemic took its toll on the fund. The most updated information, resulting from the first quarter tax returns, reveals that the fund has approximately $273 million in it at this time. Remember that the fund had $500 million in it prior to the beginning of the pandemic. Total UI payments for fraudulent claims now stands at $104 million – of which $55 million came from Rhode Island employers. During the pandemic, the unemployment insurance tax increased two schedules – from F to H. If the General Assembly votes to add even $100 million to the trust fund, then every Rhode Island business would see a one-schedule tax drop. The Chamber is asking you to call or contact your State Representative and State Senator this week. Ask them to support full replenishment of the fund, or support adding enough money to the trust fund to lower the unemployment insurance tax schedule AND to convey that support to the leadership. Thank you for taking action! Last Week at the State House The legalization of the adult use of marijuana was signed into law May 25th. It will take a little time for the regulations to be developed and adopted, but employers should review the statutes and to consider whether employee handbooks require updating. Both bills were signed by the Governor (they are identical). The bills can be viewed in their entirety at: http://webserver.rilin.state.ri.us/BillText/BillText22/HouseText22/H7593A.pdf http://webserver.rilin.state.ri.us/BillText/BillText22/SenateText22/S2430A.pdf The Senate Judiciary Committee passed S.2775, An Act Relating to Labor and Labor Relations – Payment of Wages. The bill was not amended by the committee in any way. S.2775 was introduced at the request of the Attorney General, and it designates failure to pay wages on time, failure to pay wages at time of termination, or misclassification of employees as independent contractors, as felonies subject to a prison sentence. The full senate will vote on the bill Thursday, June 2nd. The House Judiciary Committee passed H.7895, An Act Relating to Courts and Civil Procedures – Rhode Island Commercial Receivership Act, and the full house is scheduled to vote on the bill June 1st. This act would create a temporary non-liquidating receivership program for businesses that have had a substantial decline in revenue after an emergency declaration by the government or for businesses that have suspended or ceased a substantial part of their operations because of action by a governmental unit exercising its police or regulatory powers to address an emergency. The bill can be viewed at: http://webserver.rilin.state.ri.us/BillText/BillText22/HouseText22/H7895.pdf This Week at the State House Tuesday, May 31 The Senate Committee on Housing and Municipal Government is meeting at the Rise in room 211. The one bill scheduled for a vote is S.2345, An Act Relating to Motor and Other Vehicles – Parking Facilities and Privileges. Unless a SubA is posted prior to the vote, this bill requires all large parking lots (with a few exceptions) to include designated spots designed for persons transporting young children, under the age of three, and baby strollers. Lots with 101-500 spots must designate two spots; lots with 501-1000 spots must designate three spots; and lots with more than 100 spots must add one additional spot for each 500 parking spaces over 1000. Exemptions to this rule include single-family homes, duplexes, multifamily residences and industrial zoned properties. The bill contains specifications for the dimensions of the spots as well as the location. Property owners have two years from the date of enactment to comply. The bill can be viewed at: http://webserver.rilin.state.ri.us/BillText/BillText22/SenateText22/S2345.pdf The House Finance Committee is meting at the Rise in room 35. The committee will be voting on H.7863, An Act Relating to Labor and Labor Relations – Employment Security. H.7863 extends until June 30, 2023, an increase in the total amount of earnings a partial-unemployment insurance claimant can receive before being entirely disqualified for unemployment insurance benefits and increases the amount of earnings disregarded when calculating a weekly benefit rate. Without passage of this bill, these benefits (which were changed during the pandemic) end on June 30, 2022. Wednesday, June 1 The House Labor Committee will vote on S.2418, An Act Relating to Labor and Labor Relations – Employment of Women and Children. This bill is identical to H.6652 which is scheduled for a vote on the House floor the same day. The bill requires children who are 14 years of age and wish to work, to complete a three-hour training program with the Department of Labor and Training. The program, consisting of workplace health and safety content as well as workers’ compensation rights and workers’ rights, must be completed before a limited work permit can be issued to the child. The following new bills were filled last week: House Bill No. 8282 Kislak, Potter, Slater, Diaz, Cassar, Bennett, Caldwell, Craven, Morales, Williams, AN ACT RELATING TO INSURANCE -- ACCIDENT AND SICKNESS INSURANCE POLICIES (Requires health insurers, nonprofit hospital service corporations, nonprofit medical service corporations, health maintenance organizations and Rhode Island Medicaid, to issue policies that provide coverage for emergency medical services transport.) http://webserver.rilin.state.ri.us/BillText/BillText22/HouseText22/H8282.pdf Senate Bill No. 2984 Goodwin, Bell, AN ACT RELATING TO TOWNS AND CITIES -- HOUSING MAINTENANCE AND OCCUPANCY CODE (Allows a municipality to impose a debt in favor of the corporate unit against the owner when the municipality relocates the occupant and authorizes the corporate unit to choose the vendors to assist qualifying homeowners with repair costs.) http://webserver.rilin.state.ri.us/BillText/BillText22/SenateText22/S2984.pdf

0 Comments

Legislative Session Enters Final Phase

Over the next few weeks, the legislature is expected to finish up the 2022 legislative session. A budget could be posted for consideration in the House Finance Committee within the next two to two and half weeks. At the same time, both the House and Senate will be voting out bills. Please keep a look out for emails from the Chamber asking for your help in contacting legislators. Last Week at the State House Bills legalizing the adult use of cannabis passed the House Finance Committee and the Senate Judiciary Committee last week. The 125-page bills are scheduled for votes on the House and Senate floors May 24th and could be on the Governor’s desk as early as May 25th. By the end of the week, these bills will likely be law. The bills allow anyone over the age of 21 to use the drug. A Cannabis Control Commission, comprised of three commissioners, will be responsible for the regulation, licensing and control of adult use and medical use as well. The Governor appoints the members with the advice and consent of the senate. This was a compromise between control by the Department of Business Regulation and control by a legislative appointed body. The compromise addressed concerns raised by the advocates for separation of powers. For employers, the bills state clearly that workers’ compensation coverage does not include medical marijuana and that an employer is not required to accommodate the use of medical marijuana in the workplace or the possession of legal cannabis at the workplace. Remote work is treated the same as a centralized worksite. Employers may implement drug use policies which prohibit the use or possession of cannabis in the workplace or prohibit performing work under the influence of cannabis. An employer cannot fire or take disciplinary action against an employee solely for an employee's private, lawful use of cannabis outside the workplace as long as the employee is not working under the influence of cannabis. The bills carve out an exception for businesses that must maintain a zero tolerance in order to retain a federal contract or to maintain a federal license. The bills also create a carve-out for employees “in a job, occupation or profession that is hazardous, dangerous or essential to public welfare and safety. If the employee's job, occupation or profession involves work that is hazardous, dangerous or essential to public welfare and safety then the employer may adopt and implement policies which prohibit the use or consumption of cannabis within the twenty-four (24) hour period prior to a scheduled work shift or assignment. For purposes of this section, hazardous, dangerous or essential to public welfare and safety shall include, but not be limited to: operation of an aircraft, watercraft, heavy equipment, heavy machinery, commercial vehicles, school buses or public transportation; use of explosives; public safety first responder jobs; and emergency and surgical medical personnel.” Finally, employers may refuse to hire, or can terminate, an employee for working while under the influence of cannabis. The compromise bill includes language to utilize testing as science progresses over time. Today a widely accepted test that measures the amount of TCH in a person’s body is not available. This makes driving under the influence more challenging to prove. However, the bills include a saliva test in the list of tests that can be given to a person suspected of driving under the influence. Municipalities that do not currently host compassion centers can choose to opt out of offering licenses for cannabis. To do so, the following question must be placed on the ballot this November: "Shall new cannabis related licenses for businesses involved in the cultivation, manufacture, laboratory testing and for the retail sale of adult recreational use cannabis be issued in the city (or town)?" Should the electors vote to ban licensing, they can choose at a future time to again place the question on the ballot and allow for licensing. Choosing to ban licenses in the municipality also means that the community forgoes the local tax on cannabis. The state tax is set at 10%, the local tax is 3%. The bills can be viewed in their entirety at: http://webserver.rilin.state.ri.us/BillText/BillText22/HouseText22/H7593A.pdf http://webserver.rilin.state.ri.us/BillText/BillText22/SenateText22/S2430A.pdf This Week at the State House Tuesday, May 24th Call to Action for Wage Payment and Misclassification - S.2775, An Act Relating to Labor and Labor Relations – Payment of Wages is scheduled for a vote in the Senate Judiciary Committee at the Rise. At the time of the writing of this edition of Under the Dome, no amendment was posted for consideration. This bill was introduced at the request of the Attorney General, and it designates failure to pay wages on time, failure to pay wages at time of termination or misclassification of employees as independent contractors, as felonies subject to a prison sentence. NOTE: If this bill is important to your business, contact your Senator today! S.2775 will likely go to the Senate floor for a vote Thursday, May 26th or next week. http://webserver.rilin.state.ri.us/BillText/BillText22/SenateText22/S2775.pdf The House Labor Committee will vote Tuesday to require children who are 14 years of age and wish to work, to complete a three-hour training program with the Department of Labor and Training. The program, consisting of workplace health and safety content as well as workers’ compensation rights and workers’ rights, must be completed before a limited work permit can be issued to the child. The bill number is H.6652. http://webserver.rilin.state.ri.us/BillText/BillText22/HouseText22/H6652.pdf Thursday, May 26th The House Judiciary Committee is scheduled to vote on H.7895, An Act Relating to Courts and Civil Procedures – Rhode Island Commercial Receivership Act. This act would create a temporary non-liquidating receivership program for businesses that have had a substantial decline in revenue after an emergency declaration by the government or for businesses that have suspended or ceased a substantial part of their operations because of action by a governmental unit exercising its police or regulatory powers to address an emergency. The bill can be viewed at: http://webserver.rilin.state.ri.us/BillText/BillText22/HouseText22/H7895.pdf Last Week at the State House

H.7905 Sub A, An Act Relating to Labor and Labor Relations – Fair Employment Practices passed the House Labor Committee and is headed to the House floor for a vote this week. This bill voids the use of non-disclosure or non-disparage agreements in civil rights matters. H.7928, which requires larger business to file taxes electronically was held for further study, as was S.2264 which creates a new tax bracket (8.99%) for individuals making over $500,000. S.2486 SubA, An Act Relating to Labor and Labor Relations – Dignity at Work Act passed the Senate Labor Committee on a 6-1 vote. (Senator de la Cruz voted “no”). The amendment transferred the authority to handle workplace bullying cases to the Human Rights Commission, added a severability clause and a liberal construction clause – meaning it should be interpreted to allow individuals greater ability to file complaints. The full Senate is scheduled to vote on the bill Tuesday. S.2775, An Act Relating to Labor and Labor Relations – Payment of Wages was held for further study, but it is getting a lot of attention and debate. The House companion bill is H.7677. These bills were introduced at the request of the Attorney General, and they designate failure to pay wages on time, failure to pay wages at time of termination or misclassification of employees as independent contractors, as felonies. NOTE: If these bills are important to your business, now is the time to reach out to both the House and Senate! http://webserver.rilin.state.ri.us/BillText/BillText22/SenateText22/S2775.pdf http://webserver.rilin.state.ri.us/BillText/BillText22/HouseText22/H7677.pdf Unemployment Trust Fund Still Needs Your Help Prior to the pandemic, the UI Trust Fund had over $500 million in it and businesses were being taxed at a “schedule F rate”. The Fund was healthy enough that discussions were underway to drop the tax rate to “schedule E” (the lower the alphabetical designation, the lower the corresponding tax rate). As of a couple months ago, the fund dropped to about $195 million and the tax rate paid by employers is now at “schedule H” which is two schedules higher than the pre-pandemic rate. The $300 million drop in funds came from the business community alone. Without help from the State or the federal government, the business community will bear the burden of paying back the $300 million. We know that at least $70 million in fraudulent claims were paid out in Rhode Island. Of the $70 million, about $37 million was paid by the Trust Fund – meaning paid by Rhode Island employers. At the very least, employers should not be responsible to pay fraudulent claims. Employers did not want to shut their doors to customers. They did not want to lay off or terminate employees. The State made the choice to close non-essential businesses and told people to stay home. From a public health perspective, this may have been the correct choice; but it was still a choice made by the State. If it were not for the pandemic, employers would be paying less in unemployment insurance premiums today. ARPA funds are intended to be used to address losses associated with the pandemic. The UI Trust Fund experienced great loss due almost entirely due to the pandemic. Lastly, it is important to stress that once the ARPA funds are spent, those funds are gone. Should the General Assembly choose not to replenish the UI Trust Fund, and Rhode Island experiences another downturn in the economy, there will be no funds to assist the UI trust fund. In that case, the tax rate would have to be further increased or the state would have to borrow from the federal government. Please contact your legislators now and express how important it is to replenish the Unemployment Insurance Trust Fund. Call or send an email telling your own experience with unemployment insurance taxes; or use the RI Business Coalition Voter Voice link to register your support for H.7385 which calls for a full replenishment of the Fund. https://www.votervoice.net/RIBC/campaigns/94532/respond This Week at the State House Tuesday, May 17th On Tuesday, at the Rise (approximately 4:30 pm) in Room 35, the House Finance Committee is scheduled to hear testimony on H.7440, An Act Relating to Taxation – Personal Income Tax. H.7440 proposes to add one new income tax bracket at a rate of 8.99% on taxable income over $403,500 (in 2011 dollars). Adjusted for inflation, the new tax bracket would apply to taxable income over approximately $500,000 (in 2022 dollars), This act would take effect on January 1, 2023 and would not apply retroactively. Wednesday, May 18th The long talked about legislation to legalize the adult use of marijuana is scheduled for a vote in the Senate Judiciary Committee at 3:30 in room 313 at the state house, while the House bill is scheduled for a vote at the Rise (approximately 4:30 pm) in the House Finance Committee in room 35. The amendments to the two bills have not been posted for public review yet, but are expected to be posted later today or tomorrow. Both meetings will be streamed live through Capitol TV at http://rilegislature.gov/CapTV/Pages/default.aspx Thursday, May 19th The House Finance Committee has a somewhat new bill on the agenda for Thursday at the Rise in room 35. Filed last month, H.8119, An Act Relating to Health and Safety – Comprehensive Health Insurance Program, creates a comprehensive, single-payer health care insurance program. The 92-page bill, creates an agency that will oversee health insurance for Rhode Island residents as well as retirees who have the insurance but then choose to retire in another state. The health care program would include Medicaid and Medicare patients. It is envisioned to cover an extensive range of services including: Primary and preventive care; Approved dietary and nutritional therapies; Inpatient care; Outpatient care; Emergency and urgently needed care; Prescription drugs and medical devices; Laboratory and diagnostic services; Palliative care; Mental health services; Oral health, including dental services, periodontics, oral surgery, and endodontics; Substance abuse treatment services; Physical therapy and chiropractic services; Vision care and vision correction; Hearing services, including coverage of hearing aids; Podiatric care; Comprehensive family planning, reproductive, maternity, and newborn care; Short-term rehabilitative services and devices; Durable medical equipment; Gender affirming health care; and Diagnostic and routine medical testing. The program’s director must create a procedure that may permit additional medically necessary goods and services beyond that provided by federal laws. Private insurance companies are not permitted to sell duplicative services to someone covered by the single-payer plan. H.8119 then creates a trust fund to pay for the services rendered. The trust fund will accept federal Medicaid and Medicare dollars, and will collect a 10% payroll tax to be paid 80% by the employer, 20% by the employee (the employer can choose to pay up to 100%). The bill also includes a 10% tax on unearned income although the director has the authority to adjust the percentage of tax to allow for a “progressive exemption or credit for individuals with lower unearned income levels.” A 6% tax is also assessed on hospitals’ net patient services revenue. The bill can be viewed in its entirety at: http://webserver.rilin.state.ri.us/BillText/BillText22/HouseText22/H8119.pdf Revenue Estimating Conference Update As you may have read, the Revenue Estimating Conference met last week and determined that revenues are $580 million higher than anticipated back in November. The $580 million breaks down into an addition $386.7 million in FY2022 and $193 million in FY2023. For FY2022 – the current fiscal year - $284 million of the increase in revenue came largely from the personal income tax. Other significant increase in revenue collections included: $45 million business corporations, $43 million sales and use tax, $18 million insurance companies, $7.8 million state department receipts, and $2.3 million realty transfer taxes. The state also received $700,000 more in alcohol tax revenue than anticipated. In FY2023, the conferees believe the state will get $123 million more from the personal income tax, $74 million from increased sales tax revenue, $17.6 million from the insurance company tax and $11.6 million more from the business corporation tax. There are some revenue sources which are anticipated be less such as the cigarette tax collections, estate tax revenues and a few general business taxes like public utility gross tax revenues. The conferees also estimate caseload expenses to be about $159 million more than anticipated since last November with a portion of the $159 million coming from federal dollars. What became increasing clear as the revenue discussion evolved over the seven hours, is that both revenues and expenses are difficult to estimate when a war is taking place, inflation is high, supply chains are tenuous and individuals are still deciding where and how to return to the workplace. Remote Work Tax Implications During the Revenue Estimating Conference, the Division of Taxation provided testimony to the conferees surrounding the personal income tax. Director of Taxation Neena Savage clarified the status of an income tax reciprocal agreement made between a few states during the Covid 19 pandemic. During the pandemic, if an employee normally worked from an office in Massachusetts, but was permitted to work from a Rhode Island home, that employer was able to pay income taxes to the Commonwealth of Massachusetts as it would have prior to the pandemic. The agreement has expired. If the employee continues to work from a Rhode Island home, then Rhode Island tax withholding applies. This same change applies to an employee of a Rhode Island employer who is working remotely from his/her home in Massachusetts. Please contact your accountant if this situation applies to your company. There are no new bills to report this week. This Week at the State House

Tuesday, May 10th The Senate Finance Committee is meeting at the Rise (approximately 4:30 pm) in the Senate Lounge to hear testimony on S.2264, An Act Relating to Taxation – Personal Income Tax. This bill creates a new tax bracket for individuals – and pass through entities – making over $500,000 of 8.99%. The current rate is 5.99%. If you wish to submit written testimony, it must be emailed to [email protected] before 1:00 pm on Tuesday. Wednesday, May 11th The House Labor Committee will be voting on an amended version of H.7905, An Act Relating to Labor and Labor Relations – Fair Employment Practices. This bill voids the use of non-disclosure or non-disparage agreements in civil rights matters. An employer cannot “require an employee as a condition of employment, to execute a nondisclosure agreement or an agreement with a clause, that requires alleged violations of civil rights remain confidential, or a non-disparagement agreement concerning alleged violations of civil rights. Any contract provision in violation of this subsection shall be void as a violation of public policy.” This is the language from the amended version – H.7905 SubA. The original bill reads “require an employee as a condition of employment, to execute a nondisclosure agreement or an agreement with a clause, that requires alleged violations of civil rights remain confidential, or a non-disparagement agreement concerning alleged violations of civil rights or alleged unlawful conduct…” Electronic filing of Taxes is on the docket for the House Finance Committee at the Rise in room 35. H.7928 requires businesses with $5000 or more in annual tax liability, or with annual gross income of $100,000 or more, to file returns and remit taxes electronically. If passed, the new requirement would begin January 1, 2023. Failure to comply would result in a $50 fine unless reasonable cause for failure can be shown. Testimony on this bill can be submitted by Wednesday at 1:00 p.m. at [email protected] Be sure to include your name, bill number, and position in the email heading. The Workforce Bullying bill (S.2486, An Act Relating to Labor and Labor Relations – Dignity at Work Act) is scheduled for a vote in the Senate Labor Committee at 4:00 p.m. At the hearing in March, it was mentioned that an amended version may be offered prior to a Senate vote. As of Sunday, no amendment has been posted. The Senate has passed this bill multiple times. The definition of workplace bullying includes: undermine, humiliate, denigrate, or sabotage a person in the workplace; as well as threatening, intimidating, dominating, or otherwise infringing upon a person's right to dignity. Workplace bullying may take the form of interpersonal interactions, organizational practices, or management actions. Workplace bullying may take the form of harassment, incivility, abusive supervision, physical violence, aggressions and “other types of objectionable behaviors.” The behaviors may come from any level of the organization, including supervision, co-workers, subordinates, or customers. Examples of bullying cited in the bill include: Interfering with a person's personal property or work equipment; use of humiliation, personal criticism, ridicule, and demeaning comments; Overbearing or intimidating levels of supervision; Withholding information, supervision, training or resources to prevent someone from doing their job; Changing work arrangements, such as rosters, offices, assignments, leave, and schedules to deliberately inconvenience someone; Isolating, or marginalizing a person from normal work activities; Inconsistently following or enforcing rules, to the detriment of an employee; Unjustifiably excluding colleagues from meetings or communications; and Intruding on a person's privacy by pestering… The bill is very broad and provides the “bullied” employee the ability to sue both the individual(s) involved as well as the employer. To view the actual text of the legislation, go to: http://webserver.rilin.state.ri.us/BillText/BillText22/SenateText22/S2486.pdf Thursday, May 12th The Senate Judiciary Committee will take testimony on S.2775, An Act Relating to Labor and Labor Relations – Payments of Wages. S.2775, submitted at the request of the Attorney General, creates a felony offense for knowing and willfully failing to pay an employee on the designated pay day, or for failing to pay an employee the amount of wages owed at the next pay day following termination. If the value of the wages owed is between $1500 and $5000 the penalty is up to three years imprisonment or a fine of twice the value of the wages, or both. If the value is between $5000 and $10,000, the penalty is up to six years in prison and a fine of twice the wages, or both. If the value is over $10,000, the penalty is up to ten years in prison and a fine of twice the wages, or both. The bill also creates a felony penalty for employers that knowing and willfully misclassify an employee as an independent contractor. The first knowing or willful violation brings a penalty of up to three years in prison or a fine of up to two times the value of the wages or $10,000, whichever is greater, or both. The second knowing or willful offense carries a penalty of up to five years in prison or a fine of up to three times the value of the wages or $20,000, whichever is greater, or both. NOTE: If this bill is important to your business, now is the time to reach out to both the House and Senate! Testimony can be emailed to [email protected] Please include the bill number, your name, position and company in the subject line. Revenue Estimating Conference Update Last Friday, the Revenue Estimating Conference met to determine caseload numbers and certain program expenses which will be used in formulating the FY2023 budget and updating the current year’s fiscal budget (FY2022). The Conference reconvenes today – Monday, May 9th, in what is a day long meeting to hash out revenue estimates that will be used in creating the budget. Below are a few things we learned from the Caseload conference last week:

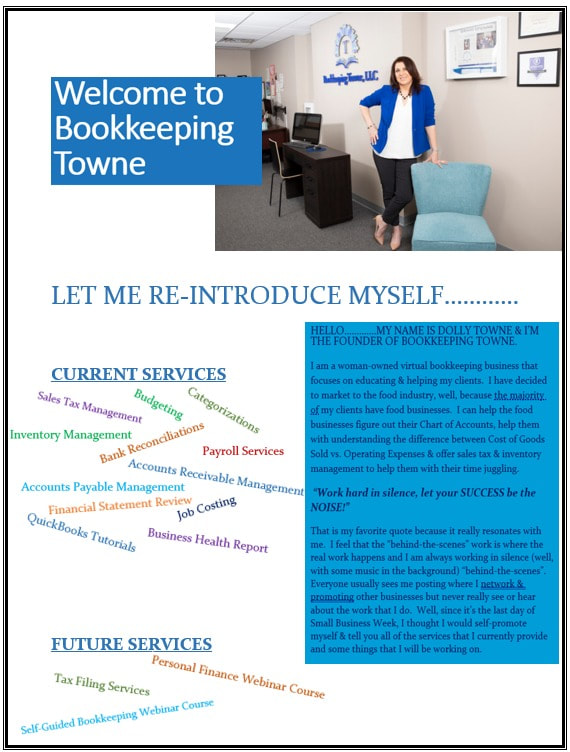

There are no new bills to report this week. Happy Friday!!! On the last day of Small Business Week, I have decided to promote my own business, Bookkeeping Towne, LLC. That is definitely one thing I don't do enough: self-promote! We are all our own advocates but we just don't do it enough. If you don't know what I do & how I help, let me re-introduce myself.......

Want to learn more about my services? Click here: https://connectwithdolly.as.me/bookkeepingqa Call to Action – Unemployment Trust Fund Replenishment

The Chamber needs your help! Last week we provided testimony again, asking for a full replenishment of the Unemployment Trust Fund. Prior to the pandemic, the UI Trust Fund had over $500 million in it and businesses were being taxed at a “schedule F rate”. The Fund was healthy enough that discussions were underway to drop the tax rate to “schedule E” (the lower the alphabetical designation, the lower the corresponding tax rate). As of a couple months ago, the fund dropped to about $195 million and the tax rate paid by employers is now at “schedule H” which is two schedules higher than the pre-pandemic rate. The $300 million drop in funds came from the business community alone. Without help from the State or the federal government, the business community will bear the burden of paying back the $300 million. As we all know, some very bad people took advantage of the pandemic by filing multiple fraudulent claims. We know that at least $70 million in fraudulent claims were paid out in Rhode Island (that number could change when the updated data is released). Of the $70 million, about $37 million was paid by the Trust Fund – meaning paid by Rhode Island employers. At the very least, employers should not be responsible to pay fraudulent claims. Employers did not want to shut their doors to customers. They did not want to lay off or terminate employees. The State made the choice to close non-essential businesses and told people to stay home. From a public health perspective, this may have been the correct choice; but it was still a choice made by the State. If it were not for the pandemic, employers would be paying less in unemployment insurance premiums today. ARPA funds are intended to be used to address losses associated with the pandemic. The UI Trust Fund experienced great loss due almost entirely due to the pandemic. Lastly, it is important to stress that once the ARPA funds are spent, those funds are gone. Should the General Assembly choose not to replenish the UI Trust Fund, and Rhode Island experiences another downturn in the economy, there will be no funds to assist the UI trust fund. In that case, the tax rate would have to be further increased or the state would have to borrow from the federal government. Please contact your legislators now and express how important it is to replenish the Unemployment Insurance Trust Fund. Call or send an email telling your own experience with unemployment insurance taxes. Thank you!!! This Week at the State House On Tuesday, May 3rd, the House Finance Committee will take testimony on many pieces of legislation. Among them are H.7440, An Act Relating to Taxation – Personal Income Tax and H.7659, An Act Relating to Taxation – Personal Income Tax. H.7440 proposes to add one new income tax bracket at a rate of 8.99% on taxable $403,500 (in 2011 dollars). Adjusted for inflation, the new tax bracket would apply to taxable income over approximately $500,000 (in 2022 dollars), This act would take effect on January 1, 2023 and would not apply retroactively. H.7659 would create a new income tax bracket at a rate of 6.99% on taxable income over $500,000. The funds collected from this new proposed bracket would be deposited into a restricted receipt account to pay for school building and school housing aid. Lastly H.7654, An Act Relating to Taxation – Business Corporate Tax will be heard on Tuesday. The bill imposes an additional tax on corporations equal to the tax cut created by the 2017 Tax Cuts and Jobs Act. It also eliminates the qualified business income deduction created by the 2017 Tax Cuts and Jobs Act available to pass-through entities. If passed, the bill would take effect on January 1, 2024. The language can be viewed at: http://webserver.rilin.state.ri.us/BillText/BillText22/HouseText22/H7654.pdf On Wednesday, May 4th, the Senate Committee on Environment and Agriculture will hear testimony on more environmental mandate bills. S.2448, An Act Relating to Motor and Other Vehicles is identical to a bill heard last week in the House Finance Committee (H.7653). At that hearing, the business community expressed a need for a holistic approach as the State tries to meet the mandated targets passed in last year’s Act on Climate. The chamber pointed out that it is imperative to perform a cost/benefit analyses prior to passage of more legislative mandates. The issues contained in S.2448 and H.7653 need to be a part of the analysis; but all of the options, costs, benefits, transition timetables, etc. should be laid out for the General Assembly prior to moving forward on any legislation. S.2448 requires 100% of all privately owned passenger and light-duty vehicles of model year 2030 or later “registered” in Rhode Island to be electric vehicles. That would mean anyone living in the state who purchased a fossil fuel vehicle outside Rhode Island or anyone moving to the state with a fossil fuel model 2030 vehicle would not be permitted to register the car here. For the person moving here from another state, that person would have to sell the car and purchase a new one in order to relocate to Rhode Island. This could be a deterrent for employers attempting to attract employees. Today in Rhode Island, there are approximately 500,000 car registrations (not including commercial vehicles). As of December 3, 2021, electric vehicle (EV) registrations accounted for 4,540 vehicles. According to Market Watch an EV car that drives 540 miles a month uses 180kwh a month. That means that the electric grid must find 180 kwh x 12 months (2,160 kwh a year) to meet the demand for each new EV purchased. Even if only 37% of the cars flipped to EVs in Rhode Island then it appears as if the electricity grid will need to find 33GW of new electricity per month (180 kwh x 185,000 EV vehicles). At a Senate Environment and Agriculture hearing earlier this year, ISO New England, the independent organization responsible for ensuring the region has reliable electricity supply, stated that it currently plans for summer peak demand because that is when New England experiences the highest usage of electricity. The “region’s all time summer peak demand was 28,130 MW on August 2, 2006.” (ISO-NE presentation can be viewed at: http://ritv.devosvideo.com/show?video=c4d8d4c3f5fc&apg=634c8273 ) The supply of electricity, which under the Act on Climate must be from renewable energy sources only, is a big concern to the Chamber of Commerce. No legislation should move forward until the state can determine how to ensure a reliable source of electricity will be available. Without reliable energy, businesses cannot operate. The following new bills were filed last week: House Bill No. 8164 Hawkins, Cardillo, Phillips, Biah, AN ACT RELATING TO BUSINESSES AND PROFESSIONS -- ELECTRICIANS (Expands the types of electrical services that require an electrical contractor's license.) http://webserver.rilin.state.ri.us/BillText/BillText22/HouseText22/H8164.pdf House Bill No. 8192 Casimiro, Baginski, Noret, Solomon, AN ACT RELATING TO STATE AFFAIRS AND GOVERNMENT -- EVIDENCE AND OVERSIGHT ACT OF 2022 (Creates the Evidence and Oversight Act of 2022 to create and maintain a data transparency portal.) http://webserver.rilin.state.ri.us/BillText/BillText22/HouseText22/H8192.pdf House Bill No. 8195 Henries, Morales, Felix, Alzate, Kazarian, Biah, Speakman, Ranglin-Vassell, AN ACT RELATING TO LABOR AND LABOR RELATIONS -- DIGNITY AT WORK ACT (Establishes a broad and comprehensive framework to provide workers with more protection and remedies from bullying and harassment in the workplace.) http://webserver.rilin.state.ri.us/BillText/BillText22/HouseText22/H8195.pdf Senate Bill No. 2892 Kallman, McCaffrey, Goodwin, Cano, AN ACT RELATING TO TAXATION -- PERSONAL INCOME TAX--CAPITAL GAINS (Amends the capital gains tax rates and holding period from 5 years to 1 year. Imposes a non-owner occupied tax on homes assessed at more than $1,000,000. Increases estate tax exemption to $2,225,000.) http://webserver.rilin.state.ri.us/BillText/BillText22/SenateText22/S2892.pdf Senate Bill No. 2895 Picard, AN ACT RELATING TO TAXATION -- STATE TAX OFFICIALS (Waives interest and penalties on the taxable portion of loans taxed or forgiven under the Paycheck Protection Program during tax years 2020 and 2021, provided any tax due is paid by March 31, 2022 and March 31, 2023, respectively.) http://webserver.rilin.state.ri.us/BillText/BillText22/SenateText22/S2895.pdf |

Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed