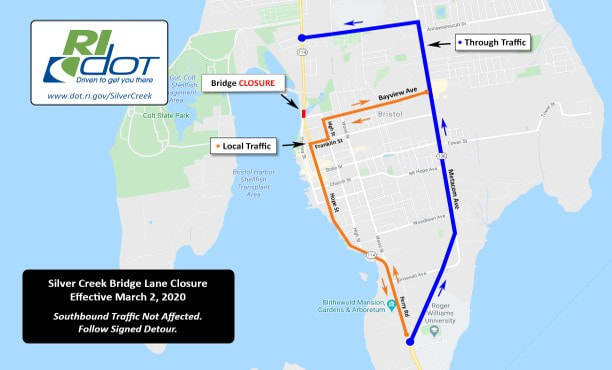

INITIAL SILVER CREEK BRIDGE DETOUR STARTS MARCH 2 What’s Happening? The Rhode Island Department of Transportation will be reconstructing the Silver Creek Bridge on Hope Street in Bristol. Southbound traffic, into downtown Bristol, will be in place during all construction. Northbound traffic will be detoured. Pedestrian and bike traffic will be allowed throughout construction. RIPTA will be posting updated schedules to accommodate the detour route. When is it Happening? The SB “one way” travel over the bridge and NB detour will be in place from March 2 to mid-June. Two-way traffic will be in place from mid-June through the 4th of July Parade. The SB “one-way” and NB detour will return on July 6 and continue until the estimated end of construction, prior to Labor Day. RIDOT Business Outreach David Walsh | 401-479-4506

2 Comments

This Week At The State House

With the first of two General Assembly breaks behind us, the legislature is expected to be in full swing for the next six weeks. Over 150 bills were filed during the break; and we anticipate hundreds more to be filed by the end of this week. On Tuesday, February 25th, at the Rise (approximately 4:30 pm), in Room 35 the House Finance Committee will take testimony concerning Article 6 of the budget. This Article increases the civil penalty for the misclassification of employees. In 2012 the business community supported an increase in this penalty to $1500 - $3000 per misclassified employee. The Governor proposes to increase the penalty to $3000 - $4000 per misclassified employee. The Article establishes a penalty for construction companies working on state projects that violate labor payment rules. The penalty would be equal to two to three times the amount agreed due and payable if the company enters into a settlement agreement with the Department of Labor. This Article also changes the hearing date timeframe for DLT from 10 days to 30 days, with a DLT timeframe to enter a decision after the hearing from 10 days to 30 days. This increase in timeframe guarantees that if a violation (innocent or deliberate) occurs, it will cost the company more in penalties as the amount due and payable adds up over the additional time allotted to DLT to respond. Article 6 also increases Fire Marshall fees for building permits and Fire Marshall fees for inspections It adds a new $15 late fee for the renewal of a driver’s license, chauffeur’s license, CDL license and car registrations that have expired. On Wednesday, February 26th, at the Rise, in Room 135, the House Health, Education and Welfare Committee will hear H.7468. This bill requires retail establishments with more than three employees, who do not have public restrooms, to allow certain customers to use the employee restroom. Eligible customers include those with the following medical conditions: Crohn's disease, ulcerative colitis, inflammatory bowel disease, irritable bowel syndrome, pregnancy, cancer or any other medical condition that requires immediate access to a restroom facility. The retail establishment is NOT required to make any changes to the employee restroom to accommodate the eligible customers. The House Labor Committee is slated to vote on S.2147 – the $1 increase in the minimum wage bill, Wednesday, February 26th. The bill is expected to pass the committee and to be voted on by the full House this week. House Finance will take testimony on Article 11 of the Governor’s budget Wednesday, February 26th, at the Rise, in Room 35. Article 11 – Relating to Economic Development seeks to accomplish the following:

On Thursday, February 27th, at the Rise in Room 211, the Senate Finance Committee will hear testimony on Article 9 of the Governor’s budget. Article 9 – Relating to Local Aid seeks to provide an incentive to municipalities to decrease the tangible tax. This opt-in program would provide communities with an opportunity to reduce the tangible property tax on the business community in an effort to attract more businesses to that municipality. In Northern RI rates like $31.25 per thousand to $46.58 per thousand are common place which ultimately stifles incentives for businesses to modernize and to grow. The Tangible Personal Property Tax Competitiveness Program works as follows: if a municipality reduces its tangible property tax rate by 6.5% or more, then it can qualify to receive 50% of the revenue lost through the tax rate reduction from a state fund; if the rate reduction is between 5% and 6.5% then the municipality is eligible to receive 25% of the levy loss resulting from the reduction in tax; if the rate is cut between 2.15% and 5% then the municipality can receive 10% of the lost revenue from the state fund. The Chamber submitted testimony at the House Finance Hearing to support this program if funds are available. Article 9 also allows municipalities to tax hospitals and higher education facilities on real estate that is not used for the core mission of the entity. Vacant lots for these entities would be considered taxable. Any Payment in Lieu of Tax (PILOT) monies received from these non-profit institutions would offset any taxes owed under the new real estate tax program. The Governor calls for an extension of the car tax phase out to 2028 instead of 2024. The following bills were filed last week: Senate Bill No. 2349 Sosnowski, Sheehan, Crowley, McCaffrey, Goodwin, AN ACT RELATING TO EDUCATION - TEACHERS RETIREMENT [SEE TITLE 16 CHAPTER 97-THE RHODE ISLAND BOARD OF EDUCATION ACT] (Provides for a stipend to be paid to certain retired state employees, municipal employees, and teachers or their beneficiaries during years when a cost of living adjustment is not scheduled.) Senate Bill No. 2352 Bell, AN ACT RELATING TO TAXATION -- DEFINITION OF CORPORATE NET INCOME (Repeals a state corporate income tax deduction to allowable income for federal tax purposes for investment property held for at least seven (7) years.) Senate Bill No. 2354 Felag, AN ACT RELATING TO TAXATION - PROPERTY SUBJECT TO TAXATION (Permits manufacturing or commercial concerns to apply to commerce corporation for exemption or stabilization of taxes when moving to another municipality if could reasonably and efficiently relocate outside state and that relocation would be advantageous.) Senate Bill No. 2357 Gallo, AN ACT RELATING TO TAXATION -- SALES AND USE TAXES -- LIABILITY AND COMPUTATION (Exempts certain equipment procured or rented by a contractor performing construction work for the state, any city or town or any quasi-public entity from the sales and use tax.) Senate Bill No. 2362 Pearson, Seveney, Cano, Paolino, Satchell, AN ACT RELATING TO STATE AFFAIRS AND GOVERNMENT - THE RHODE ISLAND MUNICIPAL INFRASTRUCTURE GRANT PROGRAM (Removes the prohibition on state appropriations to the municipal infrastructure grant program, and authorize the state planning council to evaluate, approve and issue such grants, subject to the appropriations provided to the program.) Senate Bill No. 2363 Conley, Miller, Satchell, Cano, Pearson, AN ACT RELATING TO TAXATION -- HISTORIC PRESERVATION TAX CREDITS 2013 (Repeals the sunset provision of chapter 33.6 of title 44 which grants tax credits to individuals or companies redeveloping historic structures.) Senate Bill No. 2380 Cano, Gallo, Goodwin, McCaffrey, Quezada, AN ACT RELATING TO EDUCATION -- FINANCIAL LITERACY (Develops statewide academic standards for the instruction of consumer education in public high schools by no later than December 31, 2020.) Senate Resolution No. 2383 Bell, Quezada, Goldin, Euer, Nesselbush, SENATE RESOLUTION RESPECTFULLY URGING THE UNITED STATES CONGRESS TO PASS LEGISLATION ESTABLISHING AN IMPROVED "MEDICARE FOR ALL" SINGLE PAYER PROGRAM THAT WOULD PROVIDE UNIVERSAL, COMPREHENSIVE AND AFFORDABLE HEALTH CARE Senate Resolution No. 2385 Bell, Quezada, Goldin, Euer, Nesselbush, SENATE RESOLUTION CREATING A SPECIAL LEGISLATIVE COMMISSION TO STUDY AND ASSESS THE IMPLEMENTATION OF MEDICARE-FOR-ALL SINGLE PAYER PROGRAM IN RHODE ISLAND (Creates an 11 member commission to study and assess the implementation of Medicare-For-All Single Payer in Rhode Island, and report back to the Senate one year from the date of passage, and expire two years from the date of passage.) Senate Bill No. 2389 Bell, Quezada, Goldin, Euer, Nesselbush, AN ACT RELATING TO HEALTH AND SAFETY -- COMPREHENSIVE HEALTH INSURANCE PROGRAM (Establishes single-payer universal health care for Rhode Island residents.) Senate Bill No. 2391 McKenney, AN ACT RELATING TO INSURANCE -- INSURANCE CONSUMER PROTECTION SALES ACT (Prevents businesses from selling tangible property on a condition that consumer purchases insurance prohibits businesses from using non-public information to sell insurance.) Senate Resolution No. 2406 Raptakis, Lombardo, Ciccone, Lombardi, Paolino, SENATE RESOLUTION CREATING A SPECIAL LEGISLATIVE COMMISSION TO STUDY AND REVIEW RHODE ISLAND'S MINIMUM WAGE (Creates an 11 member commission whose purpose it would be to study Rhode Island’s minimum wage, and who would report back to the Senate no later than March 1, 2021, and whose life would expire on June 1, 2021.) Senate Bill No. 2417 de la Cruz, Morgan, Paolino, Euer, Lombardi, AN ACT RELATING TO COMMERCIAL LAW - GENERAL REGULATORY PROVISIONS - ESTABLISHING THE ELECTRONIC INFORMATION OR DATA PRIVACY ACT (Electronic Information or Data Privacy Act. Limits law enforcement access to electronic data and information.) Senate Bill No. 2425 Lombardo, Archambault, McCaffrey, Goodwin, Conley, AN ACT RELATING TO COMMERCIAL LAW - GENERAL REGULATORY PROVISIONS - DECEPTIVE TRADE PRACTICES (Amends the Deceptive Trade Practices Act to clarify the law's exemptions/enables individuals subject to unfair or deceptive acts and practices to recover increased damages/permits attorney general to seek civil penalties for initial violations of law.) Senate Bill No. 2430 Conley, Gallo, McKenney, McCaffrey, Coyne, AN ACT RELATING TO COMMERCIAL LAW--GENERAL REGULATORY PROVISIONS -- CONSUMER PRIVACY PROTECTION (Creates "Consumer Privacy Protection Act.") Senate Bill No. 2437 Raptakis, Rogers, Morgan, McKenney, Lombardi, AN ACT RELATING TO MOTOR AND OTHER VEHICLES -- REGISTRATION OF VEHICLES (Permits the division of motor vehicles to suspend the registration privileges of motor carriers upon receipt of notice from the department of labor and training that the motor carrier has not secured workers' compensation insurance.) Senate Bill No. 2440 Lombardo, Lombardi, McKenney, Coyne, AN ACT RELATING TO COMMERCIAL LAW--GENERAL REGULATORY PROVISIONS -- DECEPTIVE TRADE PRACTICES (Amends the deceptive trade practices chapter to clarify the law's exemptions and enhances the attorney general's authority to seek civil penalties for violations of the law.) Senate Bill No. 2477 Morgan, Rogers, AN ACT RELATING TO LABOR AND LABOR RELATIONS (Requires most employers in Rhode Island to participate in the E/Verify employment authorization program and establishes deadlines to do so.) Last Week At The State House

Minimum Wage Activity The House passed H.7157 SubA last Thursday on a vote of 62-5. As expected, the bill was amended to mirror the Senate version – an increase to $11.50 effective October 1, 2020. The General Assembly is on legislative break this week, so the bills will not get to the Governor’s desk until the last week of February at the earliest. However, businesses should begin to plan accordingly. This Week At the State House The House and Senate are on legislative break this week. No hearings will be held. The session will resume February 25th. What’s In the Governor FY2021 Budget? Article 15 – Relating to Human Services This Article starts off with the creation of a “Geriatric parole” program. Anyone serving time (where the sentence was not “life without parole”) would be eligible for geriatric parole consideration after serving 10 years or 75% of the total sentence. A second parole option would be given to those who suffer from a cognitive incapacity such as dementia, or are severely or terminally ill. Those incarcerated still have to have their cases reviewed by the parole board. The Substance Abuse Prevention Program under the purview of the Department of Behavioral Healthcare, Developmental Disabilities and Hospitals (BHDDH) is assigned some new responsibilities including identifying funding distribution criteria for the program. Municipalities that receive substance abuse prevention grants would have to file written reports to BHDDH proving that monies received were spent in accordance with program requirements. BHDDH would also add high schools to the program target audience. Under current law, $30 of each speeding fine issued in the state goes to the substance abuse program. Article 15 proposes to transfer certain other fines to this program. A civil penalty of $150 for the possession of 1 oz. or less of marijuana – first and second offense – would be transferred to the substance abuse program as would the civil penalty of $150 for a 17 year old possessing 1 oz. or less of marijuana and the additional $300 penalty if that 17 year old does not complete a drug awareness program. The Rhode Island Works Program, which assists families while they train for careers, is changed to allow for a little more flexibility when determining income. The earned income of any adult family member who gains employment while the family is in the program can exclude the first 6 months of his/her earned income until the household reaches its 48 month time limit or until the household’s total gross income exceeds 185% of the federal poverty level, whichever comes first. The Governor also proposes to provide child care to families attending a Rhode Island college if the income of the family is below 180% of federal poverty level. Lastly, Article 15 proposes a number of changes to the state subsidies for childcare. To view the changes go to http://webserver.rilin.state.ri.us/BillText20/HouseText20/Article-015.pdf Article 16 – Relating to Veterans Affairs Under current law, Veteran’s Affairs performs a calculation at the end of each year to determine a net per diem expense of the residents of the Veterans Home. That per diem is then charged to each resident, although a resident could only be charged up to 80% of the person’s net income. A Veteran’s net come is also considered the total amount of income minus $150 per month and only 50% of monies received due to wounds incurred in battle conditions for which the resident received a purple heart. The Governor’s proposal changes the amount a resident can be charged to 100% of the person’s net income, but also increases the monthly reduction to $300 per month when calculating net income. If a resident has no stipend for battle wounds, that resident could pay less to the state for an income of $10,000 a year, but could pay more for an income of $15,000 a year. Article 19 – Relating to Workforce Development This 52 page Article focuses on the construction industry and a few other areas of policy. If you are a member of the construction industry, the Chamber strongly urges you to read the Article which can be found at http://webserver.rilin.state.ri.us/BillText20/HouseText20/Article-019.pdf Electrician (Class B) apprenticeship programs still require 8000 hours of on-the-job learning but it appears to eliminate the requirement to complete that training within 4 years. Maintenance electrician (Class M) still have 6000 hours but no longer within 3 years; and Lightning Protection Installers still need 4000 hours but no longer within 2 years. If an electrical apprentice obtained an associate degree in electrical technology, that person can get credit for 288 hours of academic instruction toward the apprenticeship requirement. The Electrician’s Board can also grant 144 hours of credit to apprentices that completed a high school electrical technology program. Changes to the apprenticeship requirements are also made for electrical sign installers, plumbers, telecommunications, refrigeration technicians, pipefitters, and oil burnerpersons. Of interest to all Rhode Island taxpayers is a section in Article 19 that only allows construction companies with apprenticeship programs, in every trade needed to build a school, to bid on a school construction project valued at $5 million or more. The Article states that 10% of the workers in each trade on the job must be apprentices, and that the company bidding must verify that it can meet this requirement at the time of bidding – not at the time the job begins. What does this mean in the real world? It means that only union construction companies will be able to bid on these projects, thus reducing the number of competitive bidders on school projects over $5 million. The Article does provide an out for the winning bidder if they determine there is a lack of apprentices in a specific field as long as the company demonstrated a good faith effort to comply. This allowance comes after the bid has been awarded, however. In a merit shop construction company (non-union), apprentices are full time employees of the individual company. The apprentice attends night classes and the individual company provides the on-the-job training requirement with approval by the Department of Labor. If the merit shop company does not have enough work for that apprentice, then – like most businesses – that employee will likely be laid off or terminated. A union construction company is different. The company calls the union hall and relays how many apprentices the company needs for a job. Joe Smith may work for one company one week and a different union company another week. Union construction companies can claim all of the union hall members as potential employees when attempting to qualify for bids. Merit shops can only claim their own full time employees. For this reason, it is extremely unlikely that any merit shop company will be able to bid on school buildings valued at $5 million or more should Article 19 pass. Article 19 adds a provision to include nonprofit organizations with more than 1000 employees in the Job Development Assessment fee. In 2020, the taxable wage base for this fee is $24,000 per employee ($25,500 for those employers that have an unemployment experience rate of 9.19 or higher); and the tax rate is .21% (.0021). Finally, this Article increases the earned-income tax credit. The Rhode Island tax credit would remain at 15% of the federal earned-income tax credit until December 31, 2020. The credit would increase to 16% from January 1, 2021 to December 31, 2021; 17% from January 1, 2022 to December 31, 2022; 18% from January 1, 2023 to December 31, 2023; 19% from January 1, 2024 to December 31, 2024; and to 20% effective January 1, 2025. The following bills were filed last week: House Bill No. 7440 Kazarian, Casimiro, Blazejewski, Williams, Alzate, AN ACT RELATING TO INSURANCE -- ACCIDENT AND SICKNESS INSURANCE POLICIES (Prohibits insurance companies from varying the premium rates charged for a health coverage plan based on the gender of the individual policy holder, enrollee, subscriber, or member.) House Bill No. 7466 Walsh, Ajello, Lombardi, Hull, Fogarty, AN ACT RELATING TO LABOR AND LABOR RELATIONS - MINIMUM WAGE--GRATUITIES (Raises the minimum wage for tipped workers by fifty cents ($.50) per year commencing on January 1, 2021 until the tipped minimum wage is not less than two-thirds (2/3) of the regular minimum wage.) House Bill No. 7467 Walsh, Ajello, Lombardi, Hull, Fogarty, AN ACT RELATING TO LABOR AND LABOR RELATIONS -- TIP PROTECTION (Prohibits employers from receiving any portion of the tips given by customers to their tipped employees, with limited exceptions for credit card service charges.) House Bill No. 7468 Ackerman, Hawkins, Shekarchi, McNamara, Chippendale, AN ACT RELATING TO HEALTH AND SAFETY -- RESTROOM ACCESS ACT (Requires retail establishments with 3 or more employees on the premises without accessible public restroom to allow customers suffering from eligible conditions access to their employee restrooms.) House Bill No. 7469 Casimiro, Alzate, McNamara, Jackson, Mendez, AN ACT RELATING TO FOOD AND DRUGS -- HEALTHY BEVERAGE ACT (Creates the "Healthy Beverage Act" which requires that children's meals offered by restaurants include certain healthy beverage options if beverage is automatically included in the meal.) House Bill No. 7491 Tobon, Barros, Alzate, Costantino, McKiernan, AN ACT RELATING TO CORPORATIONS, ASSOCIATIONS, AND PARTNERSHIPS -- RHODE ISLAND BUSINESS CORPORATION ACT (Imposes a fee of one hundred sixty dollars ($160) for all domestic and foreign corporations for a certificate of authority to transact business in this state.) House Bill No. 7500 Cortvriend, Shekarchi, Amore, Carson, Nardone, AN ACT RELATING TO TAXATION - STATE TAX OFFICIALS - SALES AND USE TAXES -- ENFORCEMENT AND COLLECTION (Allows any tax payments to be paid by midnight of the date the tax is due and also provides for a twenty-four (24) hour extension of time to pay the tax.) House Bill No. 7532 Kennedy, Abney, Edwards, Azzinaro, O'Brien, AN ACT RELATING TO TAXATION -- SALES AND USE TAXES -- LIABILITY AND COMPUTATION (Expands the definition of sales to include any license, lease, or rental of prewritten or vendor-hosted computer software and specified digital products. This act would also define "end-user" for specified digital products.) House Bill No. 7533 Carson, Cortvriend, Amore, AN ACT RELATING TO TAXATION -- STATE TAX OFFICIALS -- SALES AND USE TAXES -- ENFORCEMENT AND COLLECTION (Provides that a tax payment shall be paid by midnight on the date in which the tax becomes due and payable, and reduces the amount of penalty for taxes unpaid from a maximum of twenty-one percent (21%) to ten percent (10%).) House Bill No. 7539 Craven, McEntee, McKiernan, Millea, AN ACT RELATING TO LABOR AND LABOR RELATIONS -- PAYMENT OF WAGES (Makes failure to pay employees wages amounting to $1,500 or more a felony punishable by fines or imprisonment or both.) House Bill No. 7549 Jacquard, Kennedy, Azzinaro, AN ACT RELATING TO PUBLIC UTILITIES AND CARRIERS -- TAXI CABS AND LIMITED PUBLIC MOTOR VEHICLES (Requires national and state background checks for certain drivers transporting passengers for hire.) House Bill No. 7576 Casey, Solomon, Ruggiero, Canario, Shekarchi, AN ACT RELATING TO INSURANCE - ACCIDENT AND SICKNESS INSURANCE POLICIES (Prohibits any health insurer, medical service corporation, hospital service corporation and health maintenance organization from making prescription drug formulary changes in a contract year.) House Bill No. 7604 Blazejewski, Kislak, Cassar, Ajello, Barros, AN ACT RELATING TO HEALTH AND SAFETY -- STATE BUILDING CODE (Requires any single-user toilet facility in a public building or place of public accommodation that exists or is constructed on or after July 1, 2020, be available to persons of any gender.) House Bill No. 7611 McEntee, Bennett, Ajello, Abney, Speakman, AN ACT RELATING TO HEALTH AND SAFETY -- BEVERAGE CONTAINER DEPOSIT RECYCLING ACT OF 2020 (Creates a refundable five cent ($0.05) deposit for non-reusable beverage containers. A one cent ($0.01) handling fee would be paid by distributors.) House Bill No. 7615 Ruggiero, Bennett, Slater, Cortvriend, Chippendale, AN ACT AN ACT RELATING TO TOWNS AND CITIES -- RHODE ISLAND COMMUNITY RESILIENCY AND PRESERVATION ACT (Establishes the Rhode Island Community Resiliency and Preservation Act to provide cities and towns with the authority to propose, for consideration and decision by their voters, a reliable source of capital funding for investing in their community.) House Bill No. 7627 Phillips, Edwards, Millea, Hawkins, Shanley, AN ACT RELATING TO COMMERCIAL LAW--GENERAL REGULATORY PROVISIONS -- DECEPTIVE TRADE PRACTICES (Amends the deceptive trade practices chapter to clarify the law's exemptions and enhances the attorney general's authority to seek civil penalties for violations of the law.) Marshall Building and Remodeling awarded Angie's List Super Service Award 11th Year in a Row!2/10/2020  Marshall Building and Remodeling awarded Angie's List Super Service Award 11th Year in a Row! "Service pros that receive our Angie's List Super Service Award represent the best in our network, who are consistently making great customer service their mission," said Angie's List Founder Angie Hicks. "These pros have provided exceptional service to our members and absolutely deserve recognition for the exemplary customer service they exhibited in the past year." Angie's List Super Service Award 2019 winners have met strict eligibility requirements, which include maintaining an "A" rating in overall grade, recent grade and review period grade. The SSA winners must be in good standing with Angie's List and undergo additional screening. Service company ratings are updated continually on Angie's List as new, verified consumer reviews are submitted. Companies are graded on an A through F scale in multiple fields ranging from price to professionalism to punctuality. Last Week At The State House

Minimum Wage Activity Last week the Senate passed a minimum wage hike (S.2147 SubA) on the Senate floor 30-6. The SubA calls for an increase to $11.50 per hour starting October 1, 2020. This is more palatable than the proposal to raise the wage to $15 per hour. The implementation date is still problematic. The Chamber continues to advocate for a January 1 implementation date of any increase in the minimum wage. The House Labor Committee took testimony last week on H.7157 which calls for a wage increase to $15 by 2024. The Sponsor – Rep. Bennett – testified that he would be willing to amend his bill to mirror the Senate version. This Week At the State House This week promises to be a very busy week. This Thursday is the deadline for filing bills without going through extra hoops. Also, the week of February 17th is the first recess for the General Assembly. Today, the House Labor Committee is expected to pass a minimum wage bill identical to the bill passed by the Senate. This would call for a $1 per hour increase effective October 1, 2020. The Senate Finance Committee will take testimony today in room 211 at around 4:30 pm on the Governor’s FY2020 supplemental budget proposal to scoop, from the current year budget, $5 million from the Resource Recovery Fund, $1 million from the Oil Spill Prevention Administration and Response Fund, $1 million from the Underground Storage Tank fund, and $12.8 million from the Municipal Road and Bridge Revolving Loan Fund. The scoops appear to be more about next year’s fiscal budget than closing a deficit for the current year. According to the House Fiscal Staff report, all of the Governor’s proposed changes to the current fiscal year budget – including the scoops – would leave the State with a $24.4 million surplus which could then be used for programs next year. On Wednesday, the House Finance Committee will hear testimony in room 35 at around 4:30 pm on a 27-page budget Article that addresses tobacco and vaping issues. The Article raises the legal age to purchase tobacco to 21 which is already federal law following President Trump’s signing of a bill December 19, 2019. The Article raises the tax on a pack of cigarettes and additional $.35 (to $4.60 per pack) and gives municipalities the authority to regulate the sale of tobacco within their jurisdiction – giving rise to many different rules. The Article bans the sale of flavored vape products (other than tobacco) in the State of Rhode Island and restricts the nicotine content in tobacco flavored vaping products. The nicotine content is lower than the content in the current market products – effectively banning the products for adults. This Article has been called a response to the health outbreak from vaping. However, studies so far have shown that the vaping illnesses were linked to the use of black market vaping products – most laced with TCH (a marijuana component). The FDA is undertaking studies on specific products. Starting May, 2020, the FDA is expected to begin releasing rulings on products that can be sold on the market. Should Article 21 pass without amendment, products permitted to be sold under the FDA ruling would not be permitted to be sold in Rhode Island. On Thursday, the House Environment Committee will take testimony on H.7362 which would increase the bio requirement in heating fuel. Rhode Island was the first state in the country with a state-wide requirement (5%) that was implemented. New York has a 5% requirement for a portion of the state. Massachusetts suspended its requirement opting instead for a financial incentive to those that use a bio component. H.7362 requires increasing requirements of biobased product. The percentage requirement would increase to 10% July 1, 2023, and would continue increasing until July 1, 2030, when the percentage would reach fifty percent (50%). At this time, biofuel is more expensive to purchase than non-biofuel. The other question is the availability of the quantity of the bio component. Proponents of the bill – the oil heat industry – included a waiver provision in the language should the Governor determine product is not available or too costly, and they have testified that the addition of bio saves money on cleaning of heating systems. Governor FY2021 Budget Article 5 – Relating to Capital Development Program Article 5 is the “bond question” Article. If passed, the following questions would go before the voters in November:

The following bills were filed last week: House Bill No. 7397 Jackson, Shekarchi, Noret, Serodio, Ackerman, AN ACT RELATING TO HEALTH AND SAFETY - LICENSING OF SWIMMING POOLS (Removes the requirement to have a person trained in first aid in close proximity to operate a swimming pool without a lifeguard.) House Bill No. 7399 Blazejewski, Abney, Bennett, Carson, Ruggiero, AN ACT RELATING TO STATE AFFAIRS AND GOVERNMENT - RESILIENT RHODE ISLAND ACT OF 2014 - CLIMATE CHANGE COORDINATING COUNCIL (Establishes a statewide greenhouse gas emission reduction mandate.) House Bill No. 7414 Craven, Caldwell, McEntee, AN ACT RELATING TO COMMERCIAL LAW -- GENERAL REGULATORY PROVISIONS (Prohibits delivery service from using merchant's likeness/trademark or intellectual property on its website or delivery vehicles without written merchant consent. Requires delivery service to register to do business in Rhode Island.) House Bill No. 7435 Speakman, Knight, Donovan, Cassar, AN ACT RELATING TO TAXATION - PROPERTY SUBJECT TO TAXATION (Permits manufacturing or commercial concerns to apply to commerce corporation for exemption or stabilization of taxes when moving to another municipality if could reasonably and efficiently relocate outside state and that relocation would be advantageous.) House Bill No. 7436 Kislak, Barros, Shanley, Vella-Wilkinson, Williams, AN ACT RELATING TO TAXATION - PERSONAL INCOME TAX (Adds 3 new income tax brackets for purposes of Rhode Island income taxation.) Senate Bill No. 2171 Quezada, AN ACT RELATING TO COMMERCIAL LAW - GENERAL REGULATORY PROVISIONS (Requires a person or persons who transact business under a trade name to register with a municipality, provide more extensive information when filing and to notify the municipality when the trade name is changed or discontinued.) Senate Bill No. 2204 Pearson, Cano, Valverde, Satchell, AN ACT RELATING TO TAXATION - STAY INVESTED IN RI WAVEMAKER FELLOWSHIP (Repeals the provisions of the Stay Invested in RI Wavemaker Fellowship, and establish the Stay Invested in RI Tax Credit to provide eligible taxpayers with a tax credit for educational loan repayment expenses.) Senate Bill No. 2230 Crowley, Quezada, Nesselbush, Metts, Euer, AN ACT RELATING TO INSURANCE -- INSURANCE COVERAGE FOR MENTAL ILLNESS AND SUBSTANCE ABUSE (Requires insurance coverage for at least ninety (90) days of residential or inpatient services for mental health and/or substance-use disorders for American Society of Addiction Medicine levels of care 3.1 and 3.3.) Senate Bill No. 2236 Felag, Lombardo, Ciccone, Conley, Gallo, AN ACT RELATING TO INSURANCE-ACCESSIBLE RESIDENCE MODIFICATIONS (Allows health insurance plans to provide coverage for accessible residence modifications determined to be medically necessary.) Senate Bill No. 2287 Quezada, Crowley, Metts, Bell, Euer, AN ACT RELATING TO LABOR AND LABOR RELATIONS -- WRONGFUL DISCHARGE FROM EMPLOYMENT (Ends Rhode Island's "employment-at-will" legal doctrine, and would provide job protection for employees that satisfactorily perform their duties. The act would also provide specific remedies for wrongful discharge.) Senate Bill No. 2295 Goldin, Lynch Prata, Goodwin, McCaffrey, Murray, AN ACT RELATING TO LABOR AND LABOR RELATIONS -- FAIR EMPLOYMENT PRACTICES ACT (Changes the definition of employee and employer for purposes of the fair employment practices act, while expanding personal liability for violations.) Senate Bill No. 2296 Goldin, Ruggerio, Goodwin, Cano, Lawson, AN ACT RELATING TO LABOR AND LABOR RELATIONS -- FAIR EMPLOYMENT PRACTICES (Comprehensively addresses wage discrimination by expanding employee protections and the scope of the remedies available to employees who have experienced wage discrimination.) Senate Bill No. 2297 Raptakis, Ciccone, Lombardi, Paolino, Lombardo, AN ACT RELATING TO LABOR AND LABOR RELATIONS -- MINIMUM WAGES (Increases the hourly minimum wage to $11.10 on January 1, 2021, and commencing January 1, 2022, the hourly wage would increase in accordance with the Consumer Price Index for the Northeast Region for the four (4) previous fiscal years.) Senate Bill No. 2301 Ciccone, Lombardi, Goodwin, Felag, Bell, AN ACT RELATING TO HOLIDAYS AND DAYS OF SPECIAL OBSERVANCE -- WORK ON HOLIDAYS AND SUNDAYS (Requires an individual employer to meet certain criteria in order to qualify for class exemption from the increased pay requirement for work on holidays and Sundays.) Senate Bill No. 2304 Lombardi, Lombardo, McCaffrey, Lynch Prata, Ciccone, AN ACT RELATING TO LABOR AND LABOR RELATIONS -- FAIR EMPLOYMENT PRACTICES (Amends the fair employment practices act by clearly establishing that employees of a defendant employer may be individually liable for unfair employment practices.) Senate Bill No. 2305 Lombardi, Lombardo, McCaffrey, Lynch Prata, Ciccone, AN ACT RELATING TO COMMERCIAL LAW -- GENERAL REGULATORY PROVISIONS (Prohibits delivery service from using merchant's likeness/trademark or intellectual property on its website or delivery vehicles without written merchant consent. Requires delivery service to register to do business in Rhode Island.) Senate Bill No. 2308 Quezada, Crowley, Metts, Bell, AN ACT RELATING TO HOLIDAYS AND DAYS OF SPECIAL OBSERVANCE -- HOLIDAY AND SUNDAY WORK (Removes health care and maintenance workers from the definition of employees not entitled to overtime pay, for purposes of overtime pay on Sundays and holidays, enabling them to collect overtime pay.) It's always a pleasure when members drop in to say hello! Today Chuck Staton the founder of Staton's Landscaping Inc. in #Warren came by to make some connections at the Chamber.

Did you know?... Staton's Landscaping specializes in residential and commercial landscaping services. Their services include lawn design, maintenance, renovation, fertilization, tree pruning & removal, storm water management, and irrigation services- And SNOW REMOVAL! www.Statonslandscapinginc.com You are always welcome at the EBCC! Last Week At The State House

Last week the Senate Labor Committee replaced S.2092 (the workplace bullying bill) with an amended version that further expanded actions of employees for which an employer could be held liable. The amended version included acts such as: pestering, ignoring to the point of isolation, harming another’s emotional tranquility, and overbearing supervision. The Chamber pointed out that this bill is actually more troublesome than the original bill. S.2092 SubA was held for further study. Chairman Ciccone asked all parties to provide written comments to aid the Committee in its deliberation. S.2147, was amended to call for a one time raise of $1 per hour in the minimum wage starting October 1, 2020. The wage would go to $11.50 per hour. S.2147 passed the Committee on a 4-2 vote. It will be sent to the full Senate for consideration. This Week At the State House The House Finance Committee will meet on Tuesday At the Rise (around 4:30pm) in Room 35 to receive a briefing from the House Fiscal Staff on the Governor’s budget. The meeting will be televised on the local access channel. No public testimony will be accepted at this meeting. The House Environment and Natural Resources Committee will meet on Thursday At the Rise to discuss a number of packaging bills and to accept public testimony. H.7163 bans the use of plastic straws unless specifically requested by the customers and does not allow businesses to supply a dispenser on counters. H.7164 bans the use of polystyrene containers. H.7306 bans the use of plastic bags. Governor FY2021 Budget Article 3 – Relating to Government Reform and Reorganization This Article starts out addressing the licensing of home inspectors. The passage of a licensing test was required up to July, 2019. Article 3 moves the test requirement date to December 31 2019. It also provides an alternative avenue for licensing of two years in the practice of conducting home inspections and 150 home inspections completed prior to December 31, 2019. Under current law, the inspections had to be complete prior to July 1, 2013. This may be a clean-up section to address those who failed to achieve the hours or inspection requirements by the July 2019 date. The Article has similar language for well-drilling contractors. Current law calls for the implementation of a test requirement starting January 1, 2018. This Article changes the written testing date to July 1, 2020. Licensing for roofing contractors would become a two-year license instead of a one-year license and would allow them to spread the ten continuing roofing education requirements over two years. The Article eliminates the need to obtain a $100,000 bond for each single project undertaken but would increase the insurance certificate amount from $1.5 million to $2 million. Lastly, the Article extends the testing grandfather clause (no test required) if the roofer was registered and in good standing by July 1, 2015 (current law says July 1, 2003). Article 3 changes the way payments made by individuals convicted of a crime are distributed. Current law calls for restitution to the victim first, then court cost, fees and fines. This proposal calls for the court costs and expenses related to prosecution to be paid first, then restitution, then court fines and fees. The State has the right to sell seized property that was obtained illegally if that property would otherwise be destroyed and the property is not harmful to the public. Ten percent (10%) of the funds raised through the sale of the property currently goes to the Department of Health. Article 3 proposed to divert that 10% to the Department of Behavioral Healthcare, Developmental Disabilities and Hospitals (BHDDH) for substance abuse prevention and treatment programs. Commercial Drivers’ License (CDL) skills tests would be transferred from CCRI to DMV with the fee set at $100 per test. Last year’s budget established a pilot program for the collection of debts owed to the State. This budget Article requires all agencies and quasi-public agencies to participate in the debt collection program by October 1, 2020. It gives the Department of Revenue the ability to negotiate settlements. If less than 50% of the debt is collected, the new collection unit keeps 15%. Article 3 also addresses municipal debts owed to state agencies. Under current law, municipalities have 180 days to pay bills of state agencies and quasi-public corporations. The budget Article changes the timeframe to 90 days and then allows the state to withhold sales tax revenue or public service corporation taxes due to the municipality if the debt is not paid within the 90 day period. The last portion of Article 3 places the constitutional question of a line item veto before the voters in Rhode Island. A line item veto would allow the Governor to veto specific items in the budget, and allow the reminder to pass into law. It would also allow the Governor to reduce the sum of a specific item. The General Assembly could then choose to take votes to override the veto or restore funding levels with a 2/3 majority vote of both the House and Senate. Article 4 – Relating to Debt Management Act Joint Resolutions Article 4 calls for the following:

The following bills were filed last week: House Bill No. 7333 Edwards, Canario, Williams, Bennett, Shekarchi, AN ACT RELATING TO BUSINESSES AND PROFESSIONS -- ELECTRICIANS (Allows 288 hours of trade school training to qualify for the journeyperson "B" electrical exam. Increases the period of indentured apprenticeship with the department of labor and training and a licensed electrician master to 4 years.) House Bill No. 7339 Edwards, Newberry, Canario, Vella-Wilkinson, Kennedy, AN ACT RELATING TO INSURANCE -- ACCIDENT AND SICKNESS INSURANCE POLICIES (Requires that a participant or beneficiary incur no greater out-of-pocket costs for emergency services than they would have incurred with an in-network provider other than in-network cost sharing.) House Bill No. 7344 Place, Quattrocchi, Nardone, Chippendale, Roberts, AN ACT RELATING TO ALCOHOLIC BEVERAGES -- MANUFACTURING AND WHOLESALE LICENSES (Increases the amount of malt beverages that a manufacturer can sell for offsite consumption from twenty-four 12 oz. And Twenty-four 16 oz. bottles or cans to Fifty-five 12 oz. and forty-one 16 oz. bottles and cans respectively.) House Bill No. 7362 Ruggiero, Bennett, Kennedy, Handy, Blazejewski, AN ACT RELATING TO HEALTH AND SAFETY - BIODIESEL HEATING OIL ACT OF 2013 (This act would require ever increasing requirements of biobased product in No. 2 distillate heating oil. By July 1, 2023, ten percent (B10 - 9.5 - 10.5%) of No. 2 distillate heating oil would be biobased product. This would increase on a set schedule until until July 1, 2030 when fifty percent (B50 - 49.5 - 50.5%) would be biodiesel and/or renewable hydrocarbon diesel product in No. 2 heating oil.) House Bill No. 7363 Jacquard, Cassar, AN ACT RELATING TO INSURANCE -- INSURER RECEIVERSHIP MODEL ACT (Establishes a process for insurers who wish to utilize receivership rather than the other processes of liquidation or rehabilitation.) House Bill No. 7367 McNamara, Ruggiero, Bennett, Jackson, AN ACT RELATING TO INSURANCE-ACCESSIBLE RESIDENCE MODIFICATIONS (Allows health insurance plans to provide coverage for accessible residence modifications determined to be medically necessary.) House Bill No. 7372 Edwards, Diaz, Canario, Blazejewski, Shekarchi, AN ACT RELATING TO PUBLIC PROPERTY AND WORKS -- LABOR AND PAYMENT OF DEBTS (Amends the definition of public works so that it would include any public works projects performed for any city or town or quasi-municipal entity and the state and any quasi-state entity.) House Bill No. 7384 Edwards, Canario, AN ACT RELATING TO HOLIDAYS AND DAYS OF SPECIAL OBSERVANCE (Expands the definition of "employee" to add any individual employed in a food service establishment, which would include a caterer licensed by the department of health and division of taxation, and a food truck |

Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed